Fraud Detection

Stay ahead of fraudsters and protect your organisation with DetectX® Fraud Detection solution, equipped with cutting-edge AI and real-time threat analysis.

DetectX® - Unmatched AI for Proactive Fraud Detection

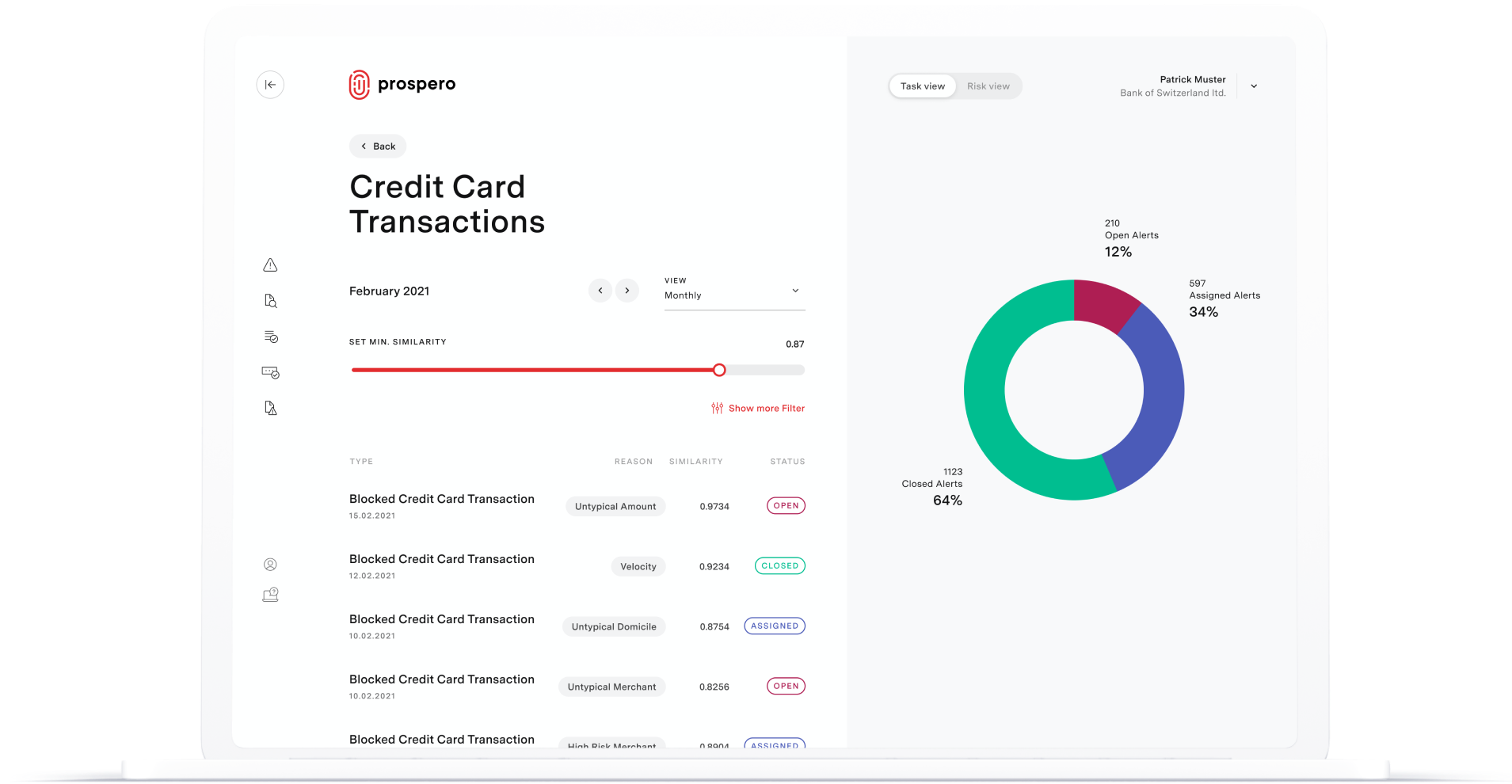

DetectX® revolutionises fraud prevention by combining AI-driven behavioural analysis, name screening, business rules engine and predictive modelling. With the ability to detect and neutralise threats before they escalate, DetectX® provides unparalleled security for financial transactions, customer data, and organisational integrity.

As fraud schemes become increasingly sophisticated, businesses across all sectors need robust defences to mitigate risks. DetectX® Fraud Detection analyses vast amounts of data in real-time, recognising patterns and anomalies indicative of fraudulent activity. By leveraging machine learning, business rules and advanced analytics, DetectX® empowers organisations to act swiftly, prevent financial loss, and strengthen overall security.

Why Choose DetectX® Fraud Detection for Unparalleled Security?

DetectX® stands out for its ability to detect complex and evolving fraud tactics. By integrating Behavioural Analysis, Anomaly Detection, and Risk-Based Profiling, DetectX® offers a comprehensive approach to fraud prevention, reducing false positives and maximising operational efficiency.

Comprehensive Fraud Detection Tools

Discover how DetectX® leverages advanced AI-driven predictive analytics to enhance Fraud Detection, AML and KYC processes.

Download brochure to learn more about the platform's capabilities in real-time transaction monitoring, name screening, and risk profiling, all designed to ensure compliance and safeguard your organisation against financial crime. Learn how DetectX® can streamline your compliance efforts and protect your business.

Regulatory Compliance

DetectX® ensures compliance with global regulatory standards, including GAFI/FATF recommendations and national regulations. Rest easy knowing your organisation’s fraud prevention strategy is aligned with the latest legal requirements.